Case Study: Bell Socialization Services

REDUCING COSTS AND LIMITING EXPOSURE OF UNEMPLOYMENT CLAIMS

Summary:

A review of Bell Socialization Services (BSS) Unemployment Program developed by UC Solutions Group (UCSG). Due to their 501c3 status and SUTA exemption, BSS elected to become a reimbursing employer at the beginning of 2008 and work with UCSG in lieu of paying the PA Unemployment Tax. UCSG’s solution was to cover all claim liabilities and adjudication for BSS in exchange for an annual premium. In this case study, we analyze the financial impact realized by BSS: a savings of 51% compared to what they would have owed as a taxpaying employer.

Analysis:

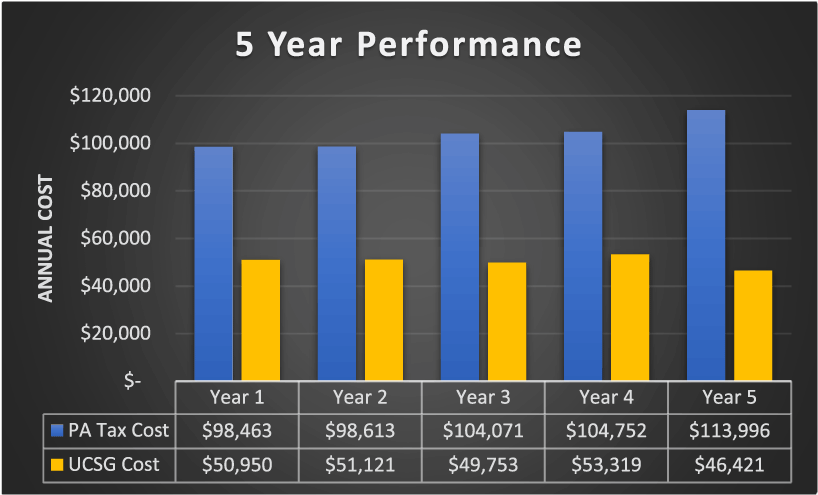

To assess UCSG’s performance, we compared the total premium due each fiscal year to the total estimated tax contribution that would have been due to PA. PA’s UI tax rate is an experience rated factor and is determined every 12/31 by adding the fiscal year aggregate of contributions & claims to a perpetual reserve account. This rate is then multiplied by reported taxable payroll ($10,000 per employee) and expensed each quarter.

Results:

Over a five-year period, BSS would have owed PA $519,895 in payroll taxes. During this same period, UCSG’s program received $251,564 in premium, which equates to a savings of $268,331 (51.61%). Active management of claims has played a significant role in reducing overall costs. UCSG’s third-party claim administrator, PeopleSystems, processes on average 65 claims annually; helping to reduce on average $317,391 in unemployment claim liability for BSS.

Find out what hundreds of nonprofit organizations already know. Contact Us today to learn more about your options.